When it comes to purchasing a car, securing the best subprime auto loans can be a game-changer for individuals with less-than-perfect credit scores. Whether you're looking to buy a new or used vehicle, understanding the nuances of subprime loans is essential. This article will explore the intricacies of subprime auto loans, helping you make informed decisions.

Millions of Americans face challenges in securing traditional auto loans due to poor credit histories. Subprime auto loans provide a viable alternative, allowing borrowers to access financing despite credit issues. However, navigating this financial landscape requires knowledge and strategic planning.

In this article, we will delve into the world of subprime auto loans, offering valuable insights, expert advice, and actionable tips. By the end, you'll have the tools necessary to secure the best subprime auto loan tailored to your needs.

Read also:Bonefish Grill Va Beach Va A Complete Guide To Dining Atmosphere And More

Table of Contents

- Understanding Subprime Auto Loans

- Benefits of Subprime Auto Loans

- Challenges Associated with Subprime Loans

- How to Qualify for Subprime Auto Loans

- Factors Affecting Loan Terms

- Subprime Loan Rates

- Top Lenders for Subprime Auto Loans

- Tips for Securing the Best Loan

- Alternatives to Subprime Auto Loans

- Improving Your Credit Score

Understanding Subprime Auto Loans

Subprime auto loans are specifically designed for individuals with lower credit scores. These loans cater to borrowers who may not qualify for traditional financing options. Lenders offering subprime loans assess various factors beyond just credit scores, such as income stability, employment history, and debt-to-income ratio.

While subprime loans come with higher interest rates, they provide an opportunity for borrowers to rebuild their credit profiles over time. By making consistent payments, individuals can gradually improve their credit scores, paving the way for better financial opportunities in the future.

Who Qualifies for Subprime Auto Loans?

- Individuals with credit scores below 620

- Those with a history of bankruptcy or foreclosure

- Borrowers with limited credit history

Benefits of Subprime Auto Loans

Despite the higher interest rates, subprime auto loans offer several advantages:

- Access to Financing: Subprime loans provide a pathway for individuals with poor credit to secure auto financing.

- Credit Improvement: Consistent payments can lead to improved credit scores over time.

- Flexible Options: Borrowers can choose between new and used vehicles, depending on their budget and needs.

Challenges Associated with Subprime Loans

While subprime auto loans offer opportunities, they also come with challenges:

- Higher interest rates compared to prime loans

- Potential for longer repayment terms

- Risk of predatory lending practices

It's crucial to work with reputable lenders and thoroughly review loan terms before committing.

How to Qualify for Subprime Auto Loans

Qualifying for subprime auto loans involves meeting specific criteria set by lenders:

Read also:Discover The Best Movies And Entertainment With Luxmoviesco Your Ultimate Guide

- Stable employment history

- Consistent income

- Reasonable debt-to-income ratio

Lenders may also require a down payment to mitigate risk. Providing accurate documentation of your financial situation can strengthen your application.

Documentation Required

- Proof of income (pay stubs, tax returns)

- Identification (driver's license, social security card)

- Proof of residency (utility bills, lease agreement)

Factors Affecting Loan Terms

Several factors influence the terms of subprime auto loans:

- Credit score

- Vehicle type (new or used)

- Loan amount

- Down payment size

Understanding these factors can help borrowers negotiate better terms and reduce overall costs.

Subprime Loan Rates

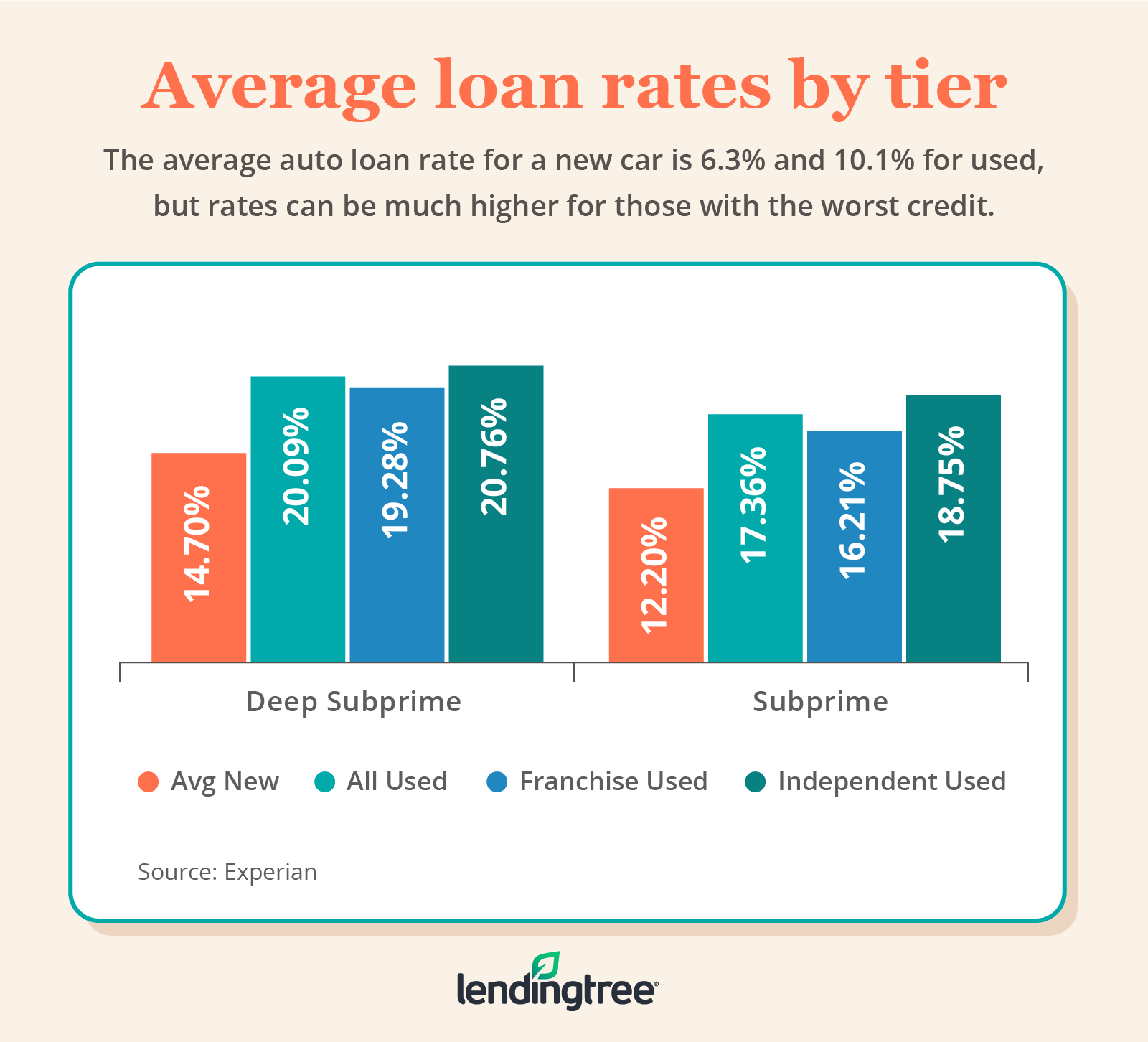

Interest rates for subprime auto loans vary based on individual circumstances. According to the Federal Reserve, rates for subprime borrowers typically range from 10% to 20%. However, some lenders may charge even higher rates depending on risk factors.

It's essential to compare offers from multiple lenders to secure the most competitive rate. Additionally, negotiating terms and providing a larger down payment can help reduce interest costs.

Comparing Rates

When comparing subprime loan rates, consider the following:

- Annual percentage rate (APR)

- Repayment term length

- Fees associated with the loan

Top Lenders for Subprime Auto Loans

Several reputable lenders specialize in subprime auto financing:

- Credit Unions: Often offer competitive rates and personalized service.

- Online Lenders: Provide convenience and transparency in the application process.

- Dealership Financing: Some dealerships offer in-house financing options for subprime borrowers.

Researching and comparing lenders is key to finding the best fit for your financial situation.

Key Considerations When Choosing a Lender

- Reputation and customer reviews

- Loan terms and conditions

- Customer service availability

Tips for Securing the Best Loan

Securing the best subprime auto loan involves strategic planning and preparation:

- Shop around for multiple loan offers

- Improve your credit score before applying

- Provide a substantial down payment

- Understand all terms and conditions before signing

By taking these steps, you can maximize your chances of securing favorable loan terms.

Common Mistakes to Avoid

- Not reviewing loan terms carefully

- Accepting the first offer without comparison

- Ignoring hidden fees and charges

Alternatives to Subprime Auto Loans

For those seeking alternatives to subprime auto loans, consider the following options:

- Co-Signer: Adding a co-signer with good credit can improve loan terms.

- Leasing: Leasing a vehicle may offer lower monthly payments compared to purchasing.

- Saving for Cash Purchase: Delaying the purchase until sufficient funds are available can eliminate the need for financing.

Evaluating these alternatives can help you make an informed decision based on your financial goals.

Improving Your Credit Score

Improving your credit score is a long-term strategy that can lead to better financial opportunities:

- Pay bills on time consistently

- Reduce overall debt levels

- Monitor credit reports for errors

By actively working to improve your credit, you can access more favorable loan terms in the future.

Resources for Credit Improvement

Conclusion

In conclusion, securing the best subprime auto loans requires a combination of knowledge, preparation, and strategic decision-making. By understanding the nuances of subprime loans and working with reputable lenders, you can access the financing you need to purchase a vehicle. Remember to review all terms carefully and consider alternatives if necessary.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for further insights into personal finance and automotive topics. Together, we can empower you to make informed financial decisions.